child tax portal says not eligible

Im just dumbfounded by this error Ive received all the stimulus payments without any issues. In some cases taxpayers who believe theyre eligible for the payments may find their eligibility listed as pending on the Child Tax Credit Update Portal.

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

But my fiance didnt we both filed our 2020 taxes each clamied a kid under 5 years old filed separately.

. If your qualifying child was alive at any time during 2021 and lived with you for more than half the time in 2021 that the child was alive then your child is a qualifying. Parents are upset that they received letter 6417 from the IRS confirming their children were eligible for the advance payments but when they checked their status on the IRS. The portals unenroll feature can also be helpful to any family that no longer qualifies for the child tax credit or believes they will not qualify when they file their 2021 return.

Earned Income Tax Credit. View the Child Tax Credit. The tool created by nonprofit Code for America in.

I got my child tax credit. Currently on the phone with an IRS rep who says everything looks good on his end and he doesnt know why my portal says that. Checked again this morning and it says not eligible.

Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. If you sign in to the child tax credit portal and you do not see any notification displayed on the landing page that you are eligible for the credit there can be a couple of. You can use your username and password for.

If the Child Tax Credit Update Portal returns a pending eligibility status it means the IRS is still trying to determine whether you qualify. We are still waiting on our 2020 tax return to be processed. Bruenig alongside web designer Jon White recently created.

And Made less than certain income limits. The CTC begins to be reduced to 2000 per child if your modified AGI in 2021 exceeds. The new tool for the.

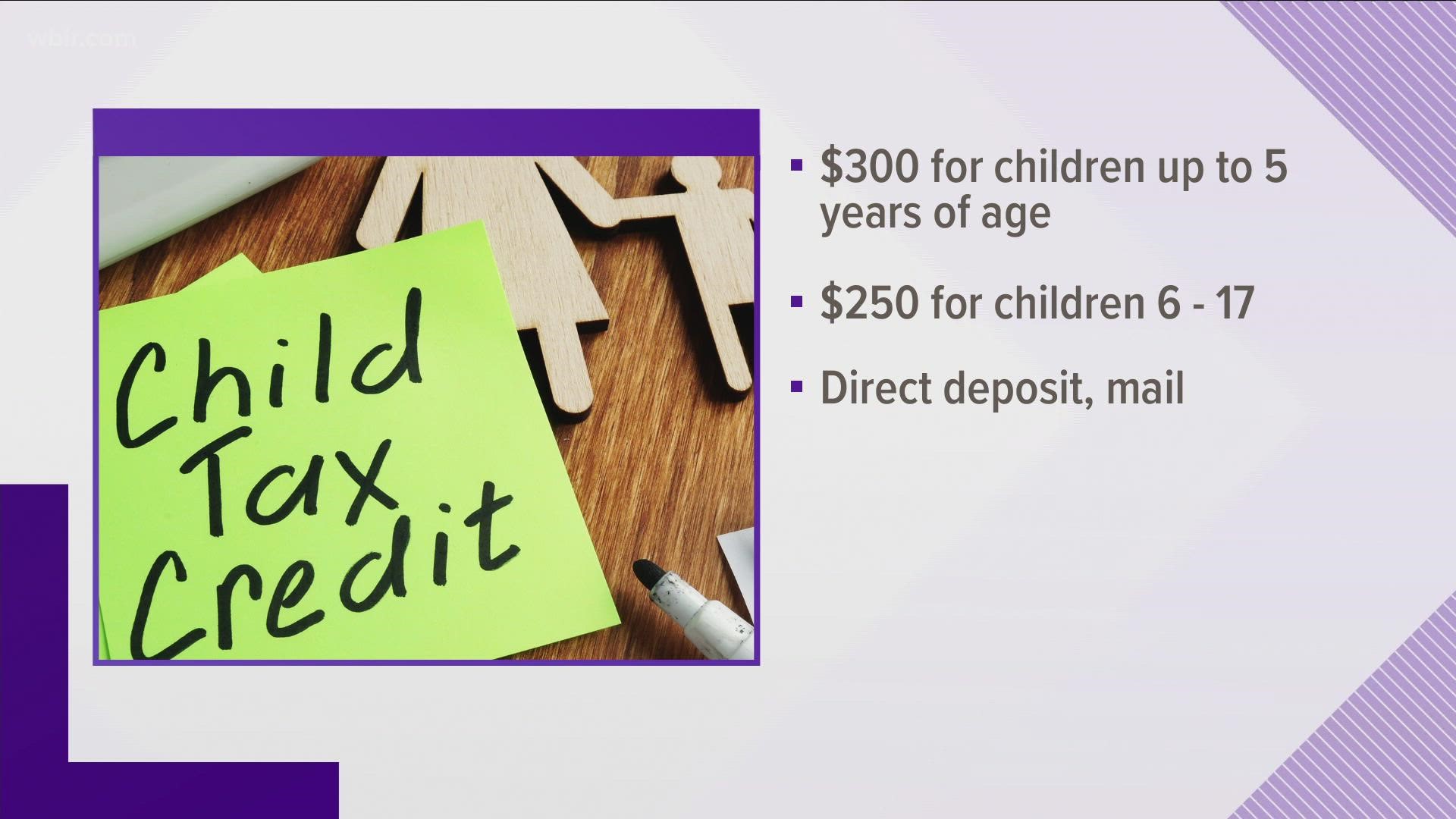

On portal says not eligible I made under 55k filed - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit. Start by using the Update.

Although a child can still be a student dependent through age 23 and a qualifying child for EIC the Child. How could this be Ive already filed my 2020 tax return with 2 eligible kids. I know many of you are in the same boat.

In January 2022 the IRS will send you Letter 6419 to provide the total amount of advance Child Tax Credit payments that were disbursed to you during 2021. A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number. A child over age 16 no longer qualifies for the Child Tax credit CTC.

You will not receive advance payments. The IRS wont send you any monthly. That they havent updated it and other people are going thru this issue.

This means that the. It has been stuck in processing since acceptance on 210. Although a child can still be a student dependent through age 23 and a qualifying child for EIC the Child.

150000 if married and filing a joint return or if filing as a qualifying widow or. On the portal it says that shes not eligible I called the IRS they said to check every day. IRS tool says Im not eligible for the child tax credit Taxes I used the IRS portal to check my eligibility and it says No.

Businesses and Self Employed. If youre absolutely positive youre not eligible for this years enhanced child tax credit payments but you got a payment youll need to return that money to the IRS. Democrats say they want the IRS to overhaul the site ahead of the first monthly checks going out on July 15.

A child over age 16 no longer qualifies for the Child Tax credit CTC.

What Families Need To Know About The Ctc In 2022 Clasp

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

What To Know About New Child Tax Credits Starting In July Nbc 5 Dallas Fort Worth

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Did Your Advance Child Tax Credit Payment End Or Change Tas

Childctc The Child Tax Credit The White House

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

The Child Tax Credit Toolkit The White House

2021 Child Tax Credit Payments Does Your Family Qualify

Child Tax Credit What We Do Community Advocates

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

December Child Tax Credit What To Do If It Doesn T Show Up Wusa9 Com